Afterpay - Buy Now Pay Later

What is Afterpay?

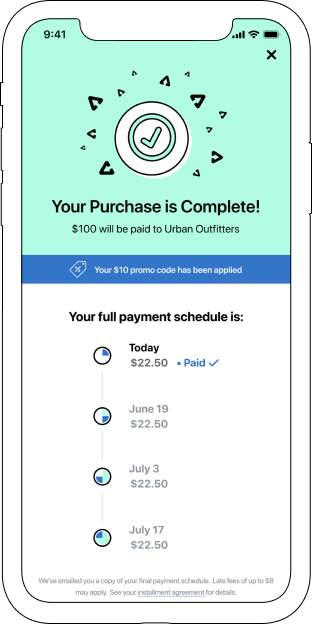

Afterpay is a "buy now, pay later" service that allows customers to split their purchases into four equal installments over six weeks, with the first payment due at checkout and the remaining three automatically deducted from their linked debit or credit card every two weeks, all without incurring interest if paid on time; essentially, you can buy something now and pay for it gradually over a short period with no extra charges if you meet the payment schedule. For larger purchases they offer 6 and 12 month payment options with variable rates.

How does Afterpay work?

Ready to start shopping? You’ll need the app for that.

STEP 1

App It

Download the app. Login or create an account and follow the instructions in the app to add the Afterpay card* to your digital wallet.

STEP 2

Tap It

Go to the Card tab to see the amount you are pre-approved to spend. Tap the “Open Wallet to Pay In-Store” button to activate the Afterpay card and tap your phone to complete your purchase.

STEP 3

Own It

You’re all set! Get ready to enjoy your new furniture and pay the rest later.

Am I eligible for Afterpay?

To use Afterpay, you must be at least 18 years old. Eligibility is subject to your financial circumstances. But don’t worry – applying won’t affect your credit rating. Before checking out, eligible customers see what interest they will pay on the principal over a six or twelve month period and only pay what they agree to.

Will placing an order with Afterpay affect my credit rating?

Afterpay was founded on the principle of financial inclusion with customer protections built in. This means customers checking out with Pay Monthly go through a quick and simple approval process through a soft credit check, which does not impact credit scores.

Can I pay before the due date?

Yes you can! If you want to pay the outstanding balance of your Afterpay purchase, simply log in to your Afterpay account, go to the “Payments” section, and you will see the option to pay off the full order amount. You can also use the Afterpay app to manage repayments and purchases.

Have Additional Questions?

Please visit Afterpay’s website to learn more.

Can I use Afterpay for online orders?

Currently, we are offering Afterpay to our walk-in customers only.

How much is the interest on my purchase?

One of the standout features of Afterpay’s Pay Monthly solution is that consumers never pay compounding interest, with an annual percentage rate ranging from 6.99% to 35.99%

How will I know what my rate will be?

Before checking out, eligible customers see what interest they will pay on the principal over a six or twelve month period and only pay what they agree to.

*You must be 18 or older, a resident of the U.S. and meet additional eligibility criteria to qualify. Loans through the Afterpay Pay Monthly program are underwritten and issued by the First Electronic Bank. A down payment may be required. APRs range from 6.99% to 35.99%, depending on eligibility and merchant. As an example, a 12 month $1,000 loan with 21% APR would have 11 monthly payments of $93.11 and 1 payment of $93.19 for a total payment of $1,117.40. Loans are subject to credit check and approval and are not available in all states.